Focused on improving your customer service and delivering orders to the doorstep as fast as possible? Read also about a new last-mile optimization experiment in anyLogistix.

A major international OEM faced increasing complexity in managing its European automotive aftermarket supply chain. The company managed over 16,000 SKUs and more than 4,000 dealers while aiming to meet strict one-day delivery targets. As a result, it struggled with inventory imbalances, stockouts, and manual sourcing processes across its multi-tier distribution system. Smart sourcing became critical to meet service levels and contain logistics costs.

MEVB Consulting GmbH developed a full-scale digital twin of the client’s automotive aftermarket supply chain using anyLogistix. The model simulated real-world operational conditions, including cross-docking flows, stock transfer policies, and fallback sourcing. A custom dynamic sourcing algorithm was implemented to automatically reroute orders based on real-time inventory and lead-time data, replacing static sourcing rules and manual decision-making.

The automotive aftermarket, comprising replacement parts and accessories, was valued at $784 billion in 2023. Driven by aging vehicle fleets, increasing consumer demand for faster repairs, and the rapid expansion of e-commerce, this market is expected to continue expanding.

However, this growth also brings growing complexity, particularly for Original Equipment Manufacturers (OEMs). They must compete with agile third-party parts providers while maintaining high service levels, cost efficiency, and logistical precision across complex automotive aftermarket supply chains.

Recent market rankings highlight how thin margins can be in this environment. Top-performing OEMs, such as Ferrari, lead the sector with operating margins exceeding 28%, while others, including prominent Japanese, Korean, and European brands, operate between 9% and 16%. Efficiency in spare parts logistics and smart sourcing has a direct impact on these margins, especially when next-day delivery is expected across diverse geographies.

Top 15 automakers by operating margin according to the Companies Market Cap (click to enlarge)

In this context, the client, one of the top automotive OEMs, faced numerous operational challenges in managing its European automotive aftermarket supply chain. These included handling more than 16,000 unique spare part SKUs, servicing over 4,000 dealerships, and meeting a strict one-day delivery benchmark across six countries.

The distribution network was complex, centered around a main distribution center (DC) and five national DCs, all connected via daily truck line hauls and an intermediate tier of regional hubs.

Stockout risks, unpredictable demand patterns, service-level agreements with dealers, and logistical challenges tied to remote locations further complicated this operational environment. Inventory sourcing was managed through manual coordination and static rules. This was an approach that lacked flexibility and failed to deliver the agility needed in today’s competitive aftermarket landscape.

One of the top automotive OEMs partnered with supply chain optimization experts at MEVB Consulting GmbH.

The project’s key objective was to develop a digital twin that would accurately replicate the OEM’s current automotive aftermarket supply chain. The team aimed to:

MEVB Consulting chose anyLogistix software to build a comprehensive digital twin for its client. To ensure the model reflected real-world automotive aftermarket supply chain operations, the consulting company focused on the following inputs in the software:

Focused on improving your customer service and delivering orders to the doorstep as fast as possible? Read also about a new last-mile optimization experiment in anyLogistix.

The process of automotive aftermarket supply chain digitalization with anyLogistix (click to enlarge)

At the core of the solution was a customized XDOC (cross-docking) sourcing policy, enabled by a dynamic, multi-level fallback algorithm. Unlike traditional static rules, this algorithm evaluated each sourcing decision in real-time, based on current inventory levels and expected delivery times.

If a required SKU was unavailable at the national DC, the system automatically fell back to the central DC or other regional hubs, rerouting the shipment to ensure on-time fulfillment. Forced routing logic through the central DC was also implemented to maintain operational control and traceability.

The model was designed to be flexible enough to simulate both best- and worst-case scenarios, including emergency reallocation during stockouts. The client’s master data, cleaned and prepared in collaboration with its internal data team, was key to accurately representing the real supply chain.

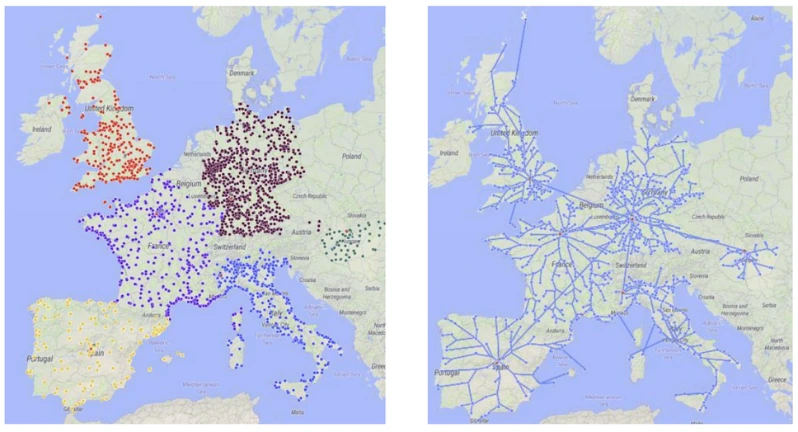

A GIS map displaying the elements of the supply chain scenario and their connections

The team delivered a validated simulation model that transformed the client’s spare parts logistics management. Through “what-if” scenario testing, the team assessed alternative smart sourcing policies, inventory strategies, and safety stock profiles. It helped to achieve:

Beyond technical performance, the model delivered clear business impact. The client’s senior leadership used heatmaps and KPI dashboards generated from the simulation results to guide strategic decisions. This marked a shift from manual planning to data-driven, scenario-based forecasting.

The digital twin enabled the leading OEM to adapt more quickly to changing market conditions and better serve its dealer network.

Encouraged by the project's success, the client is now moving towards deeper integration of the simulation model into their IT infrastructure. Planned enhancements include automated data ingestion from ERP and WMS systems, AI-based demand forecasting, and seamless integration with business intelligence dashboards.

This case study was presented by Emanuele Morra, MEVB Consulting GmbH, at the anyLogistix Conference 2025.

The slides are available as a PDF.